Knowingly supplying false information on this form is a Class D Offense under Maines Criminal Code punishable by confinement of up to one year or. To apply for the exemption the resident must provide documentation by filling out The Active Duty Stationed in Maine Excise Tax Exemption Form.

Taxes 2020 These Are The States With The Highest And Lowest Taxes

2021 -- 1750 per 1000 of value.

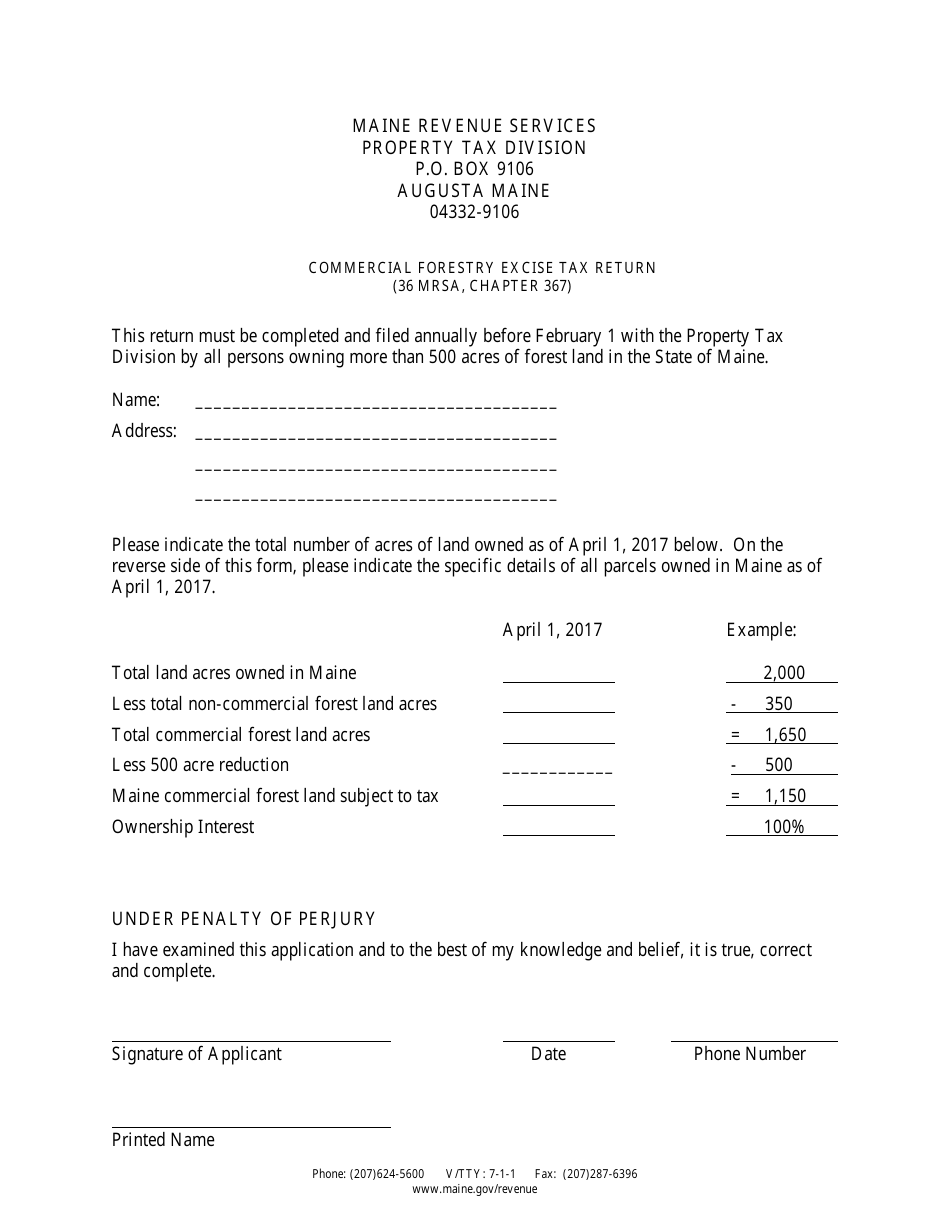

. The Commercial Forestry Excise Tax CFET is imposed on owners of more than 500 acres of commercial forest land. Excise tax is calculated by multiplying the MSRP by the mill rate as shown below. Town of Eliot 1333 State Road Eliot Maine 03903 207 439-1813.

When importing malt liquor into Maine. A registration fee of 3500 and an agent fee of 600 for new vehicles will also be charged for a total of 64180 due to register your new vehicle. Boat Registration Form Use Tax Certificate required for new registrations Boat Dealer Registration.

AvaTax Excise works with AvaTax to give you the rates you need for sales and excise taxes. MAINE REVENUE SERVICES SALESEXCISE TAX DIVISION. The Form can be found at Bureau of Motor Vehicle Web site or the link below.

This individual is permanently assigned to the unit and station identified above is on active duty and is not a member of the Guard or Reserves. See also additional excise tax below Maine manufacturer When selling low-alcohol spirits products to a. Registering Vehicles and Excise Tax.

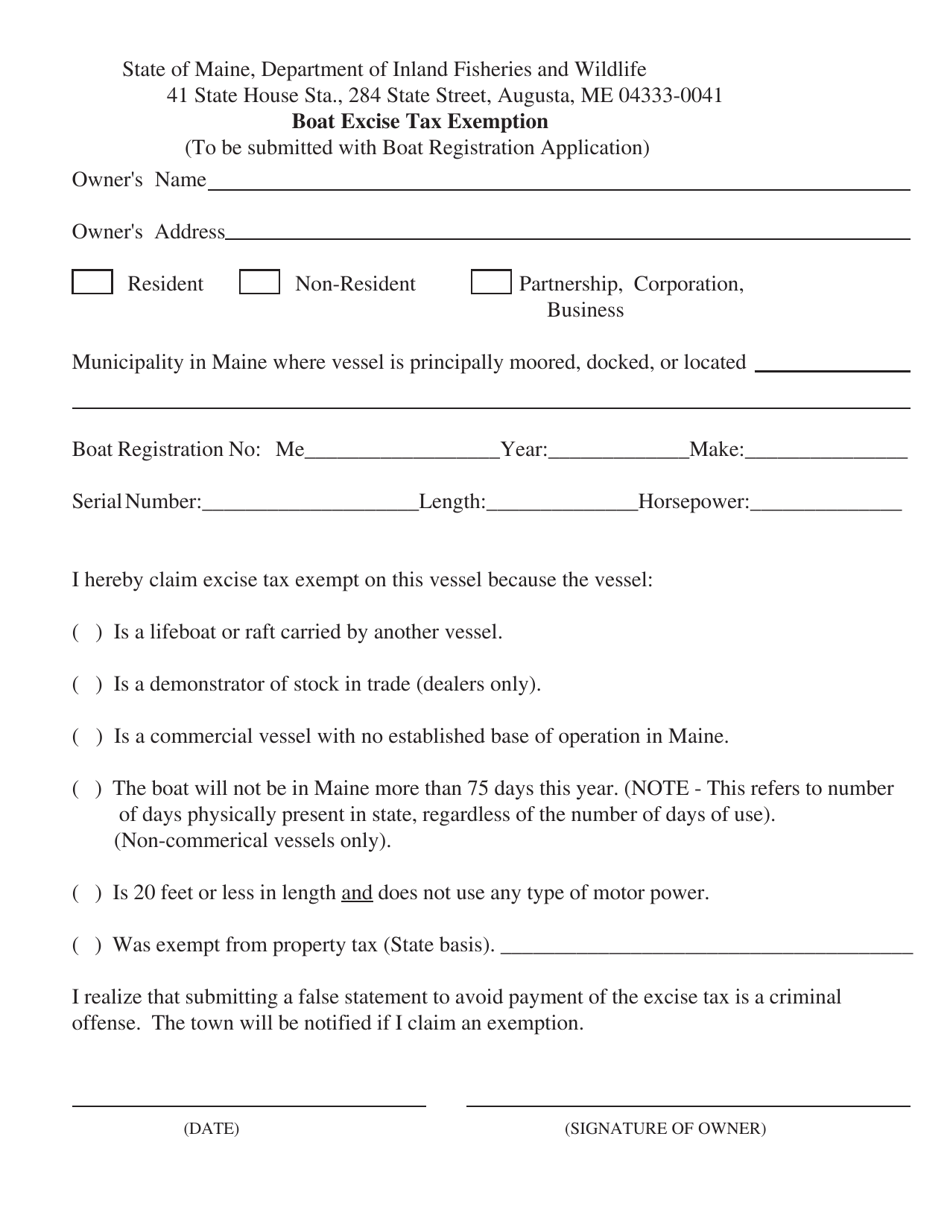

Below you will find the Town of Eliot Boat Excise Tax Payment Form for downloadcompletion along with the Maine Watercraft Excise Tax Table for computing the boat excise tax due. Home of Record legal address claimed for tax purposes. 2018 -- 650 per 1000 of value.

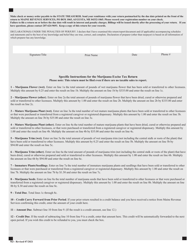

Period Begin Period End Due Date. The purpose of the tax is to partially offset the costs of forest fire protection expenditures of the Department of Agriculture Forestry and Conservation. In Maine you may deduct the sales taxes paid on the purchase of a new vehicle.

YEAR 4 0100 mill rate. The excise tax due will be 61080. OWNERSHIP OR NAME CHANGE.

The Maine excise tax on liquor is 579 per gallon higher then 52 of the other 50 states. How is the excise tax calculated. The application and instructions for the Off-highway refund is found on the Fuel Tax Forms page.

Total Excise Tax Due multiply line 7 by 035 thirty-five cents 8. Individual Income Tax 1040ME Corporate Income Tax 1120ME Estate Tax 706ME Franchise Tax 1120B-ME Fiduciary Income Tax 1041ME Insurance Tax. 2022 Watercraft Excise Tax Payment Form.

Wildlife Rehabilitator Annual Report Form 2019. YEAR 6 0040 mill rate. The rates drop back on January 1st of each year.

2022 Watercraft Excise Tax Payment Eliot Maine. Because all liquor stores in Maine are state-owned excise taxes for hard alcohol are set by the Distilled Spirits Council of the United States DISCUS. Boat Launch Season Pass - Piscataqua River Boat Basin.

Pursuant to MRS Title 36 Ch. Calculation will be based on. 112 15041 excise tax shall be paid within 10 days of the first operation of the watercraft upon the waters or prior to July 1st whichever comes first.

Check here if this is an AMENDED return. Electronic Request Form to request individual income tax forms. HttpwwwmainegovsosbmvformsMV-720Active20Duty20Excise20Exemption20Formpdf To read the State law.

YEAR 5 0065 mill rate. YEAR 2 0175 mill rate. 2017 Older -- 400 per 1000 of value.

18 rows Commercial Forestry Excise Tax. For example the owner of a three year old motor vehicle with an MSRP of. YEAR 3 0135 mill rate.

By signing this tax excise tax report the licenseeunderstands that false statements made on this are punishable by form law. This enables residents to get their vehicle registrations and plates at the Town Hall without going to the BMV. The following vehicles must be registered and excised at the Finance Office.

I further certify that the Purchaser assumes full liability for payment to the State of Maine of any use taxes together with penalties and interest that may later be determined to be due on any purchases covered by this certificate. Real Estate Withholding REW Worksheets for Tax Credits. Marijuana Excise Tax Return.

Boat Excise Tax Exemption Form. 2721 - 2726. Excise tax paid on gasoline purchased in Maine and used for commercial purposes other than the operation of a registered vehicle on the highways of Maine may be eligible for a refund.

2020 -- 1350 per 1000 of value. 2022 -- 2400 per 1000 of value. You can also deduct the excise tax portion of your Maine vehicle registration as it based on the value of the.

The Town of Freeport is a full service agent for the State of Maine for the purpose of issuing New Registrations and transfers for vehicles. Check here and make the appropriate changes to the. Ad Automate fuel excise tax gross receipts tax environmental tax and more with Avalara.

When offering samples at a taste-testing festival. Active Duty Stationed In Maine Excise Tax Exemption MV-7 Antique Auto Antique Motorcycle Horseless Carriage Custom Vehicle and Street Rod Affidavit MV-65 Authorization for Registration MV-39 Disability PlatesPlacard Application PS-18 Duplicate Registration MV-11 Emergency Medical Services Plate Application MVR-17. Maine Amphibian and Reptile Atlasing Project MARAP Site Card.

Watercraft Excise Tax Payment Form. The calculator below will help give you an idea of what it will cost to renew the current registration on your passenger vehiclePlease note this is only for estimation purposes the exact cost will be determined by the city when you register your vehicle. Or rather you would include it along with your other sales taxes paid in lieu of the alternative choice of taking a deduction for state sales taxes paid.

Please contact our office 207-439-1817 with any questions or for assistance with the calculation of the excise tax due. 2 Low-alcohol spirits products excise tax 124gallon spirits products to Maine retailers. 2019 -- 1000 per 1000 of value.

Excise Tax Reimbursement Policy Procedures The State of Maine will reimburse Municipalities for the difference between the excise tax based on the sale price and the Manufacturer Suggested Retail Price MSRP on vehicles that are 1996 or newer and registered for a gross weight of more than 26000 lbs. Maines excise tax on Spirits is ranked 24 out of the 50 states. Clear on-road diesel used for off road purposes also may be eligible for an excise tax refund.

2022 Watercraft Excise Tax Payment Form. YEAR 1 0240 mill rate.

Maine Commercial Forestry Excise Tax Return Download Printable Pdf Templateroller

Maine Marijuana Excise Tax Return Download Fillable Pdf Templateroller

Most People Are Supposed To Pay This Tax Almost Nobody Actually Pays It Planet Money Npr

How Much To Set Aside For Small Business Taxes Bench Accounting

Looking Ahead State Tax Policy Trends To Watch Next Year

Maine Marijuana Excise Tax Return Download Fillable Pdf Templateroller

Pin On E Learning Online Mock Test

Ultimate Excise Tax Guide Definition Examples State Vs Federal

These Are The States Whose Residents Pay The Highest Taxes Income Tax Tax Refund Income Tax Return

Maine Sales Tax On Cars Everything You Need To Know

Pin By Rahul Prem Shakya On Safe Shop Online Marketing Pvt Ltd Online Marketing Business Signage Marketing

Candidates Who Have Applied For Delhi Forest Guard Vacancy 2021 They Can Download Admit Card At Its Official Webiste In 2021 Forest Department Recruitment Exam Papers

Everything You Need To Know About Restaurant Taxes

Avalara Tax Changes 2022 Energy Tax Trends

Last Minute Dash When Where How To File Those Last Minute Tax Returns Tax Return Tax Paying Taxes

Maine Boat Excise Tax Exemption Download Printable Pdf Templateroller

Dha Peshawar Balloting Date Plots For Sale Peshawar Job Ads

Ultimate Excise Tax Guide Definition Examples State Vs Federal